For your professional customers

Offer your business customers tailor-made B2B payment facilities!

Thanks to our payment facilities for your business customers, you can benefit from efficient customer paths on the web and in-store to increase your sales and build customer loyalty. With our partner Allianz-Trade, we meet your cash flow needs as well as those of your customers: you are paid instantly and your customers only pay later, in 30 days or in 3 instalments for example.

Our B2B BNPL solution makes your life easier

This offer results in a heavy operational burden and often human and manual interfaces with several entities (credit insurer, financier, collection company, etc.).

Your teams can focus on their core business.

Our solutions for

business customers

Our payment solutions are designed to meet the unique needs of B2B merchants and their business customers.

Our payment options include split and deferred payments, with the flexibility of our dedicated retail payment solutions.

Features of our B2B payment facilities

Simplicity

We like to make it simple for you and your customers, so we make sure that our payment facility solution is easy to understand and use for everyone. The process is smooth and the financing and its risks are taken care of.

Adaptability

Responding to the specific challenges of each company in terms of payment facilities is our major challenge. That's why our solution adapts precisely to your context to bring satisfaction at all levels.

Integrity

We know that it is important to feel well surrounded to move forward. Helping your brand to make payment really easy and thus strengthen the exclusive relationship you have with your business customers is our mission at your side.

Commitment

Commitment means making decisions, ensuring their proper implementation and respecting them. Our commitment to you is to serve your business needs while preserving your customers' data. Re-targeting them for our own account will never be our business.

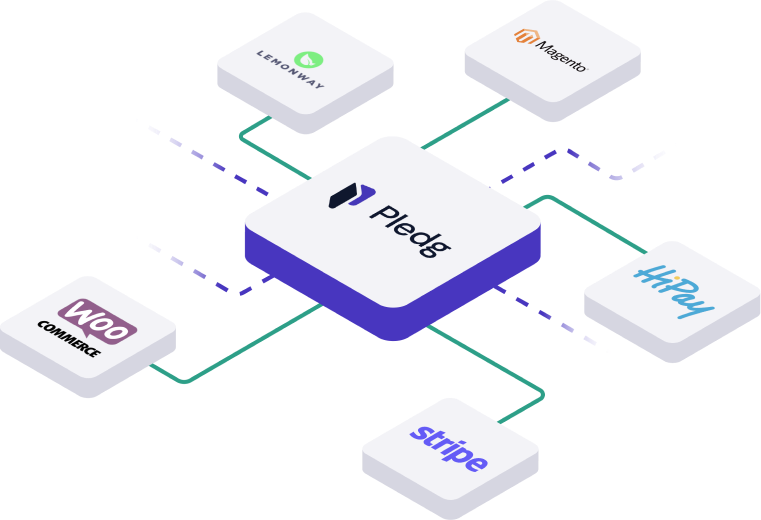

Seamless integration and a multi-channel solution for payment facilities for professionals

Our payment solutions integrate with many PSPs, such as Stripe, Hipay, Ingenico, Adyen, Paybox and many CMSs, including Magento, Shopify, WooCommerce, Salesforce, Prestashop, allowing for easy online integration via CMS module or plugin, and just as fast in physical stores and in call centers, via our back-office or by an API call from your information system

Our state-of-the-art risk management module

Our credit scoring model has proven its relevance in minimizing risk while maximizing acceptance.

Precision.

Our scoring algorithms can analyze a multitude of data, allowing them to be relevant in any context.

Finesse.

Our scoring API returns a response in less than half a second, while minimizing the customer interactions required.

Instantness.

Our real-time decision process is based on the analysis of the company name and SIREN number, your customer's data, bank information, etc., as well as data related to your own business, the context of the purchase and classic credit risk characteristics, among other relevant data points.

As soon as your customer is accepted, we pay you the full amount of his purchase and take over his insolvency risks.

100% of the amount including VAT of the transactions is insured and collected!